The Metaverse ETF is a long-term strategy for Blackrock

Only a few months ago, Blackrock established an ETF for its investors to obtain exposure to Blockchain Technology through iShares (IBLC). According to SEC filings, Blackrock is now doubling down on future technology with a Metaverse ETF. Following the market meltdown since the beginning of the year, the Metaverse ETF is a long-term strategy for Blackrock clients.

The financial status of the metaverse sector is quite competitive, as there are numerous minor projects that have yet to release their product. The Metaverse ETF will track companies with exposure in a variety of ways. This includes virtual reality platforms, gaming, augmented reality, social networking, and other technologies. The cost of investing in this fund, however, is currently unknown and will be announced in the future.The financial status of the metaverse sector is quite competitive, as there are numerous minor projects that have yet to release their product. The Metaverse ETF will track companies with exposure in a variety of ways. This includes virtual reality platforms, gaming, augmented reality, social networking, and other technologies. The cost of investing in this fund, however, is currently unknown and will be announced in the future.

In addition, shortly after partnering with Coinbase, Blackrock launched a bitcoin private trust in mid-August. According to Blackrock’s clients, bitcoin is still a “main subject of interest,” hence the multi-national investment firm developed the private BTC trust.

BlackRock has partnered with Circle

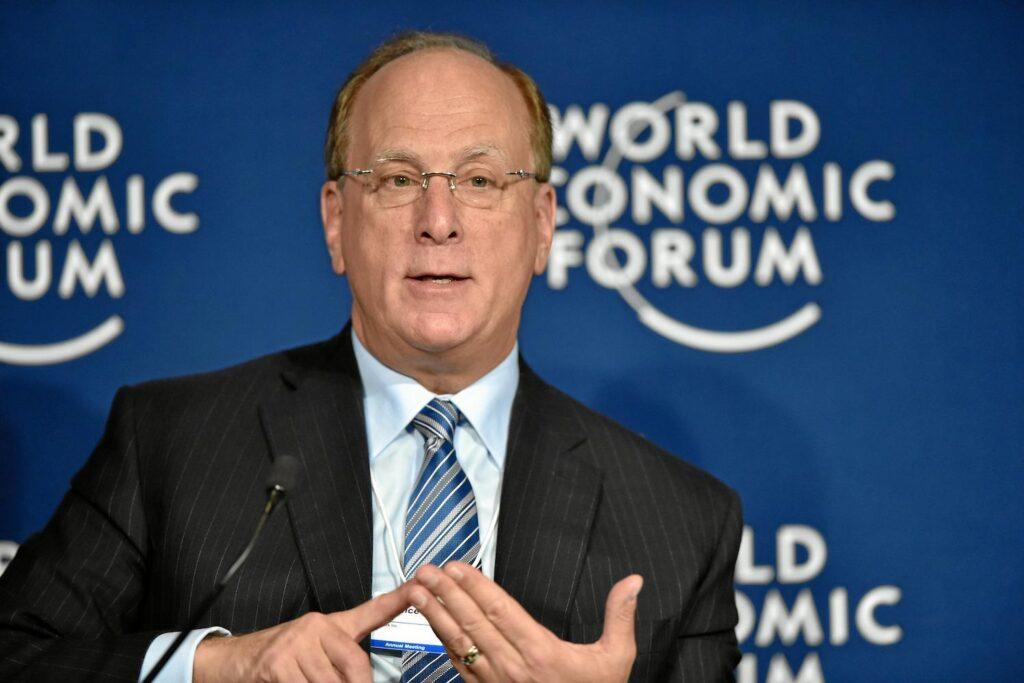

Blackrock participated in a $400 million fundraising round for Boston-based fintech firm Circle in April. In addition to its investment and role as the primary asset manager of USDC currency reserves, BlackRock has partnered with Circle to investigate capital market uses for its stablecoin. Last year, BlackRock made headlines when it introduced bitcoin futures to the derivatives products in which two of its funds can invest. The development occurred shortly after BlackRock CEO Larry Fink delivered a slightly bullish assessment of the world’s first cryptocurrency. In a rare endorsement, Fink stated that Bitcoin has ‘caught the attention’ and has the potential to largely replace gold, but cautioned of its growing popularity, which has a genuine influence on the US dollar.

Fink, who has built BlackRock into the world’s largest money-management firm, rejected bitcoin at the time as little more than a vehicle for speculation and money laundering. The BlackRock product currently has 34 holdings and costs 47 basis points. Its biggest investments are in cryptocurrency exchange Coinbase, as well as bitcoin miners Marathon Digital and Riot Blockchain, which each account for more than 10% of the portfolio. Institutional investors who were originally antagonistic to the crypto industry have altered their tune in recent years, but environmental worries about bitcoin mining have remained a barrier for many.

The business, which manages around $8.5 trillion in assets, has announced a collaboration with Coinbase that allows its institutional clients to purchase cryptocurrency, beginning with bitcoin. This comes as new institutional investors in the market are frustrated by the Securities and Exchange Commission’s refusal to approve a spot bitcoin exchange-traded fund. Only bitcoin futures ETFs have been approved thus far.